Translation: how you word your follow-up emails matters. “So, this is incredibly valuable information right now.They say the squeaky wheel gets the grease.īut the squeaky wheel can also be annoying and cause one to toss out the entire cart. “As you are well aware, we are in a purchase market and these people who have long focused on the purchase business have always knocked it out of the park, McKay observed. Yet for all the diversity in terms of methods, there was a commonality from the panelists: To a person, each identified real estate agents as their top source for business. I want you to think about and find the person that you do relate the most to because what they’re doing will probably make sense for your business.” He offered a proviso of sorts: “Also to that point, any individual one of you guys out there is not going to relate entirely with everybody on this stage – and that’s OK. You do whatever makes the most sense for you, right?” “The point of it is twofold: There’s so many different ways to do this business and be insanely successful as all these guys are. “I like opening with that because it’s the questions people ask all the time,” McKay explained to those gathered.

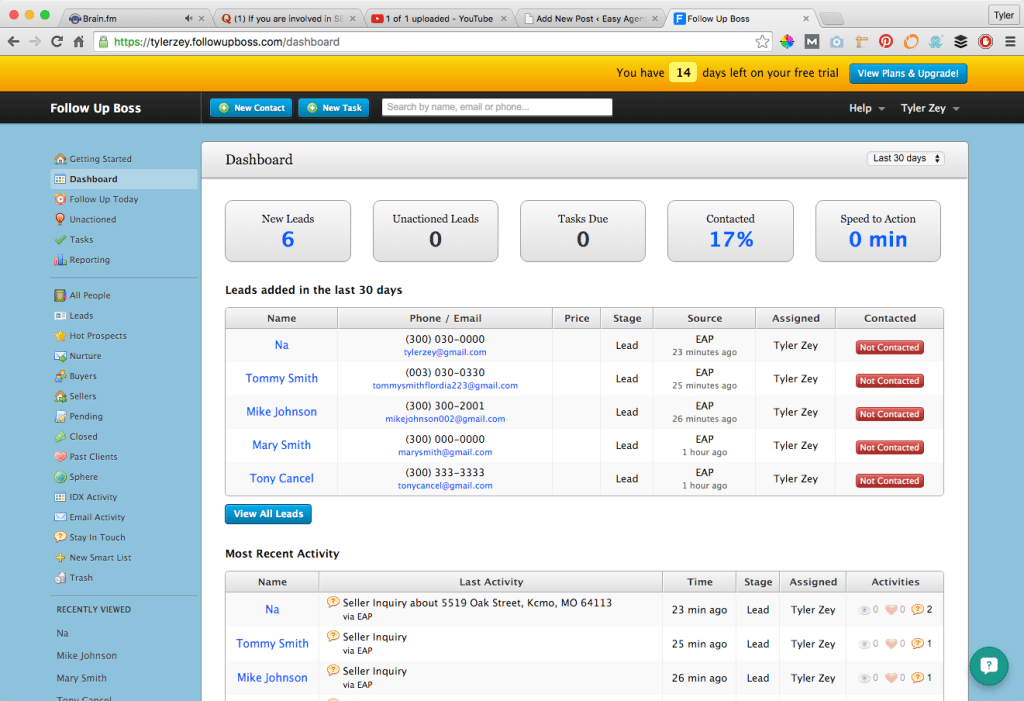

What is the answer to the ‘early bird catches the worm’? Bell, Dao and Thenhaus each said Arrive, while Singleton said LendingPad. McKay then asked each panelist to identify their preferred LOS – loan origination system aka loan origination software. McKay started by asking each panelist the CRM they use. To that end, he has distinguished himself by providing educational offerings to members of the segment in enabling them to achieve their homeownership goals. Befitting his name, Singleton does brisk business helping military veterans achieve homeownership.

#FOLLOW UP BOSS PROFESSIONAL#

In her first year at C2 Financial, she posted $44 million in volume, she told Mortgage Professional America in a previous interview earlier this month. She was among the top 1% of brokers connected to United Wholesale Mortgage, according to the bio. 1 originator in her home base of Colorado in 2020, 20. Brief bios of each panelist were provided as backdrop to the dais to illustrate their rock-star status:

Ben Bell (pictured top right), producing branch manager at UMortgage Hanh Dao (pictured below left), mortgage loan originator at Lock It Lending and Major Singleton (pictured below right), mortgage broker at Major Money Matters. Panelists included Allison Thenhaus (pictured top left), senior broker/branch manager at C2 Financial Corp. His 2020 volume comprised 81% in refinancing and 85% purchases – closely mirroring industry trends in a mercurial market. McKay is no slouch in the originations realm in his own right, ranked second in his home base of Maryland and 48th overall nationally.

0 kommentar(er)

0 kommentar(er)